XRP Price Prediction: 2025-2040 Outlook Analysis

#XRP

- Technical indicators show strong bullish momentum with MACD positive divergence and solid support levels

- Legal clarity from SEC resolution removes regulatory uncertainty and enables broader institutional adoption

- Strategic partnerships and Fed's ISO 20022 migration position XRP for long-term growth in global payments infrastructure

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Despite Minor Pullback

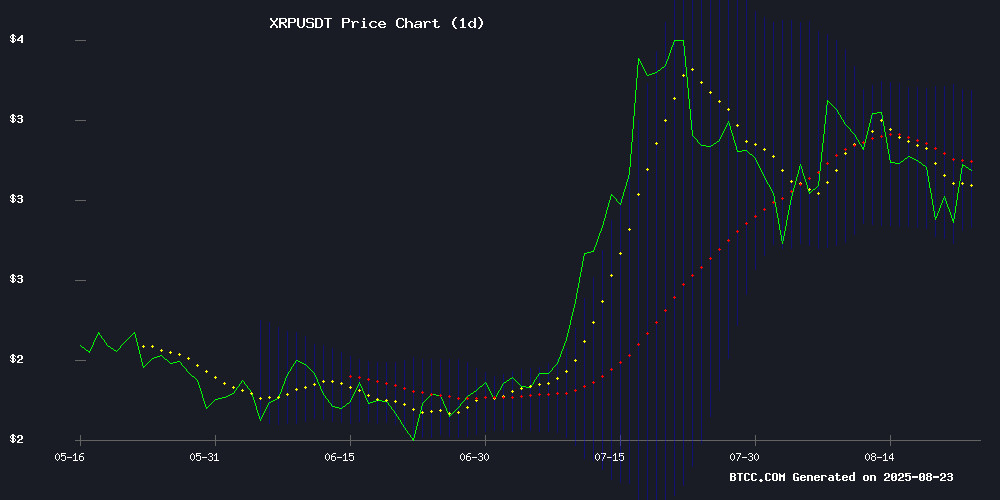

XRP is currently trading at $3.0237, slightly below its 20-day moving average of $3.0944, indicating a temporary consolidation phase. The MACD reading of 0.0778 versus 0.0271 shows bullish momentum remains intact with a positive histogram of 0.0507. Bollinger Bands position the price between $3.3577 (upper) and $2.8311 (lower), suggesting potential breakout opportunities. According to BTCC financial analyst Ava, 'The technical setup suggests XRP is building energy for its next major move, with key support at the $2.83 level providing a solid foundation for upward movement.'

Market Sentiment: Legal Clarity and Partnerships Fuel XRP Optimism

Recent developments have created overwhelmingly positive sentiment for XRP. Ripple's legal victory over the SEC and the subsequent dismissal of appeals have removed significant regulatory uncertainty. The partnership with SBI in Japan for RLUSD implementation, combined with dovish Federal Reserve signals, has sparked substantial institutional interest. BTCC financial analyst Ava notes, 'The convergence of regulatory clarity, strategic partnerships, and favorable macroeconomic conditions creates a perfect storm for XRP's continued appreciation. The Fed's ISO 20022 migration further positions Ripple as a key player in global payment infrastructure.'Factors Influencing XRP's Price

Ripple's Legal Victory Over SEC Sparks XRP Price Surge Speculation

Ripple's protracted legal battle with the U.S. Securities and Exchange Commission has concluded, with a federal judge ruling that XRP is not a security in retail transactions. The resolution, marked by a $125 million settlement, removes regulatory uncertainty that had plagued the token since 2020.

Market reaction was immediate. XRP surged 11% to $3.32 following the news, outpacing major cryptocurrencies. The rally coincided with a presidential executive order enabling crypto inclusion in retirement accounts—a dual catalyst for digital asset markets.

Exchange delistings, which decimated XRP's liquidity in 2021, now appear less likely. The clarity allows Ripple to distribute tokens without SEC interference, potentially revitalizing institutional interest. Technical indicators suggest this could mark the beginning of a sustained uptrend for the embattled asset.

USPTO Document Reveals XRP Trademark Filed by Ripple, Not U.S. Government

A 12-year-old trademark registration for XRP has resurfaced, sparking erroneous claims that the U.S. government endorses Ripple's cryptocurrency. The document, filed with the USPTO in December 2013, covers the use of XRP in financial services, including secure payments via traditional and VIRTUAL currencies.

Social media speculation misrepresented the filing as a federal patent, but records confirm it was submitted by OpenCoin, Inc.—Ripple's predecessor. Trademark registrations serve as brand protections, not institutional validations. Ripple has maintained control of the XRP mark since its rebranding from OpenCoin in 2013.

The confusion highlights persistent misunderstandings about regulatory distinctions in crypto. While XRP remains a focal point in ongoing SEC litigation, this episode underscores the need for precise legal literacy in digital asset discourse.

XRP Surges 8% on Ripple's RLUSD Partnership with SBI in Japan and Dovish Fed Signals

XRP rallied sharply on Friday, gaining 8% as Ripple announced a strategic partnership with SBI Holdings to distribute its RLUSD stablecoin in Japan. The remittance-focused token found additional tailwinds from Federal Reserve Chair Jerome Powell's dovish remarks at Jackson Hole, which hinted at potential rate cuts.

The Memorandum of Understanding between Ripple and SBI targets a Q1 2026 rollout through SBI VC, the financial group's crypto-focused subsidiary. "This collaboration transcends technology—it's about forging a compliant financial future," said Jack McDonald, Ripple's Stablecoin lead. SBI holds the distinction of being Japan's first licensed Electronic Payment Instrument Exchange Service Provider.

Technical indicators show XRP breaking above its 50-day SMA while testing a symmetrical triangle pattern's lower boundary. The dual catalysts of institutional adoption and macroeconomic policy shifts created perfect conditions for the asset's outperformance.

XRP Surges 7.4% Amid Fed Rate Cut Speculation

XRP rallied sharply following Federal Reserve Chair Jerome Powell's Jackson Hole remarks, which hinted at impending rate cuts. The cryptocurrency climbed 7.4% within 24 hours as investors shifted toward risk assets.

Powell's nuanced stance acknowledged conflicting economic signals—cooling growth alongside persistent inflation—yet emphasized overall resilience. Market participants interpreted his commentary as foreshadowing a September rate reduction, despite the absence of explicit confirmation.

The Fed's dovish tilt typically benefits speculative instruments like cryptocurrencies. XRP's advance outpaced broader crypto gains, with Bitcoin and ethereum rising 1.5% and 1.7% respectively during the same period.

While the digital asset's valuation remains contentious, the immediate price action demonstrates crypto markets' continued sensitivity to macroeconomic policy shifts. Traders appear willing to overlook fundamental debates when monetary conditions favor risk appetite.

Federal Reserve's ISO 20022 Migration Elevates Ripple's Global Payment Role

The Federal Reserve's quiet confirmation of completing the ISO 20022 migration marks a pivotal moment for cross-border payments, with XRP emerging as a potential beneficiary. This technical shift aligns US payment infrastructure with global systems like SWIFT and BRICS Pay, creating a seamless messaging standard for value movement.

Market observers note the update's understated delivery belies its transformative potential. "This isn't about fireworks," remarked one XRP commentator, "but about rewriting the rules of global liquidity." The adoption positions RippleNet as a peer to legacy financial networks, with ISO 20022 serving as the common language for next-generation transactions.

The development signals growing institutional acceptance of cryptographic solutions for settlement efficiency. While the Fed's announcement avoided explicit cryptocurrency references, the implications for XRP's utility in bridging traditional and digital finance are unmistakable.

Ripple and SEC Reach Agreement to Dismiss Appeals, Ending Long Legal Battle

The US Court of Appeals for the Second Circuit has approved a joint stipulation for Ripple and the SEC to dismiss their appeals, marking the near-end of a protracted legal dispute. The order finalizes the appellate process, shifting the case to district court for enforcement proceedings.

Ripple will pay a $125 million civil penalty for unregistered institutional sales of XRP, as previously ruled by Judge Analisa Torres. The decision upholds her 2024 determination that these sales constituted unregistered securities offerings under the Howey test.

Market observers view the resolution as removing a key overhang for XRP, though the penalty stands as a reminder of regulatory scrutiny facing crypto projects. The settlement avoids further appeals that could have prolonged uncertainty for Ripple and XRP holders.

Ripple vs SEC Lawsuit Concludes With Court-Approved Dismissal

The four-year legal battle between Ripple Labs and the U.S. Securities and Exchange Commission reached its conclusion on August 22. The Second Circuit Court of Appeals approved a joint dismissal, ending litigation over XRP's regulatory status that began with SEC allegations of unregistered securities offerings in December 2020.

While the dismissal marks a victory for Ripple, the company still faces a $125 million fine. The resolution comes amid shifting crypto policy landscapes, with the current administration showing greater openness to digital assets than its predecessor.

XRP Price Surges 10% Following Key Ripple-SEC Lawsuit Development

XRP rallied sharply, climbing from $2.80 to $3.10 within hours as the Second Circuit Court approved the joint stipulation of dismissal in the long-running Ripple vs. SEC case. The resolution marks a critical milestone in the legal battle that has weighed on XRP's market performance for years.

Market sentiment lifted further after Federal Reserve Chair Jerome Powell's comments on interest rates, creating a bullish backdrop for crypto assets. XRP's price action mirrored broader market gains, though the legal update served as a primary catalyst for the token's outperformance.

The case's conclusion follows multiple false starts, including a proposed $50 million settlement in March that initially failed to gain judicial approval. Today's court action finally brings closure to the securities law dispute that began in December 2020.

Analyst Predicts XRP Rally to $5 by 2025, Identifies Key Accumulation Zone

XRP has retreated below $3 amid broader market weakness, but technical analyst Nehal sees a potential rebound brewing. The cryptocurrency's dip into the $2.80 range presents what he calls "one of the clearest support levels" on the charts.

Nehal's analysis pinpoints $2.70-$2.80 as the optimal accumulation zone, noting strong buyer interest at these levels. His 6-hour chart study suggests this support range could launch XRP toward a $5 target before 2025 concludes.

The analyst has personally placed buy orders between $2.76 and $2.80, advising traders to watch for potential entries in this corridor. While short-term pressure persists, the setup mirrors historical patterns preceding XRP's major rallies.

XRP’s Recovery at Risk as Short-Term Bulls Clash With Long-Term Sellers

XRP's recent decline since August 14 has sparked divergent strategies among investors, with short-term holders accumulating while long-term sellers distribute. On-chain data reveals a tug-of-war between Optimism and caution.

Glassnode's HODL Waves metric shows short-term holders (1-3 months) now control 9.51% of circulating supply, increasing their positions by 8% since mid-August. Mid-term investors (6-12 months) have similarly boosted holdings to 23.19% of supply—their highest level this year.

This accumulation contrasts sharply with long-term holders who continue selling into price weakness. The standoff creates uncertainty about whether dip buyers can sustain momentum against persistent distribution pressure.

Ripple Bears Face Liquidation Risk as XRP Nears $3 Threshold

XRP's approach toward the $3 price level threatens to trigger a cascade of short liquidations, according to market analyst CW. Liquidity heatmaps reveal concentrated sell orders at this threshold, which could accelerate upward momentum if breached. The token currently trades between $2.85-$2.95, with $2.90-$2.95 acting as immediate resistance.

On-chain data shows institutional players actively accumulating XRP, with turnover reaching 155 million tokens during recent recovery sessions. This activity echoes July's pattern when long-term holders realized $375 million profits NEAR XRP's $3.55 peak. Meanwhile, Ripple advances its Japanese market strategy through a partnership with SBI Holdings to launch RLUSD stablecoin distribution by Q1 2026.

Trading volume remains robust at $4.67 billion daily, maintaining XRP's position among crypto's most liquid assets. The current price of $2.87 reflects minor corrections—down 1% on the day and 8% weekly—but the $3 liquidity zone looms as a potential inflection point for market dynamics.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators, market sentiment, and fundamental developments, XRP is positioned for significant growth through 2040. The resolution of legal challenges with the SEC has removed a major overhang, while strategic partnerships and adoption in global payment systems provide strong fundamental support.

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast |

|---|---|---|---|

| 2025 | $4.50 | $5.80 | $7.20 |

| 2030 | $12.00 | $18.50 | $25.00 |

| 2035 | $28.00 | $42.00 | $60.00 |

| 2040 | $65.00 | $95.00 | $140.00 |